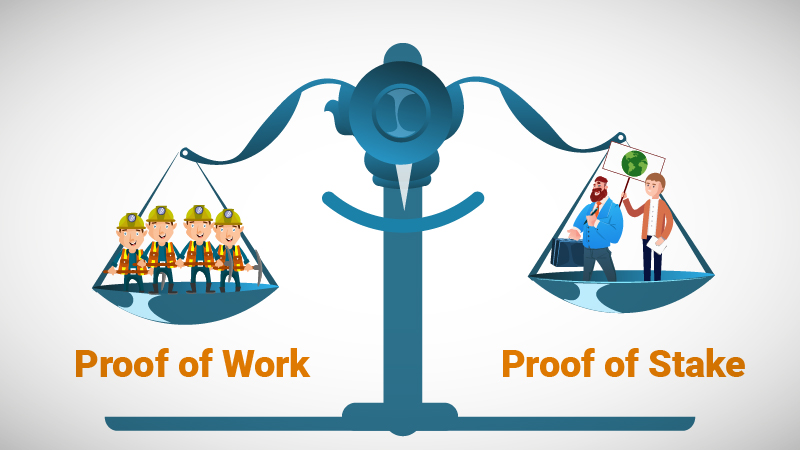

Staking is a concept in cryptocurrency literature that means stacking. The Staking concept is a model that some cryptocurrencies have developed to support transactions that take place on blockchain networks. The Staking concept was introduced into the literature with the development of the Proof of Stake consensus algorithm by Scott Nadal and Sunny King in 2012 as an alternative to the Proof of Work algorithm.

As you know, many cryptocurrencies use the Proof of Work (PoW) algorithm, which bitcoin uses to generate consensus on transactions that take place on the blockchain network, for the production and transfer of cryptocurrencies. This algorithm is the mechanism that allows mining users to perform mining. In order for mining to be done, special systems created for mining are needed. Machines such as ASIC machines or computers with a high graphics card/processor are the tools that people who want to make mining should budget.

Although the Proof of Work algorithm is a great invention, it is not exactly a perfect model. The main reason for this is that both the mining users who are integrated into the network spend a lot of money on the machines and systems they build to perform operations, and that these systems spend a lot of electricity. In addition, blockchain networks using the Proof of Work algorithm can perform a very small number of operations at the same time. When the Proof of Stake algorithm was published, it was stated that the PoW model required $150,000 of electricity per day for transactions carried out on the Bitcoin network. In 2012, the figures on this tape were subsequently expressed in millions of dollars, which means very high electricity costs. While there was also an average of 10 minutes spent on a transaction in Bitcoin transactions, spending averaged as much as $40 per transaction in 2017, when Bitcoin made its first big jump. Although Ethereum, which works with the PoW algorithm, has reduced this to 16 seconds for a process, we can say that this is not the best processing time.

The Proof of Stake algorithm, which is developed due to all these reasons, is based on the support of users to transactions performed on the blockchain network.

How does Proof of Stake work?

In the Proof of Stake mechanism, the process does not function in the same way as the proof of Work algorithm. To put it simply, the cryptocurrency staking process refers to the locking of existing cryptocurrencies in the pocketbook where staking is applied to verify transactions that are carried out by consensus. In cryptocurrency staking, you lock the coin to be processed, and in the process you lock, you stop all transactions, including deposits and withdrawals. Once you lock your cryptocurrencies for staking purposes, you cannot transfer them to another wallet. At the end of the Staking process you are rewarded by the system. You can compare this to the deposit interest transaction processes that exist in banking systems. You deposit your assets into your deposit account for a certain period of time and you will not touch your deposit during this process. The bank will pay you for this at certain rates with the name of deposit interest. Most understandably, the staking model is similar to this.

Proof of Stake is still used as proof of Work, but the object of the system is different. While the object used in this system is the cryptocurrency that exists in the network, the object used in PoW is the mathematical problems that are solved to verify the operations done in the network.

In short, staking is the process of locking existing cryptocurrencies in their wallets to support the execution of transactions on the blockchain network for cryptocurrencies using the Proof of staking algorithm.

How Are Staking Awards Calculated?

Cryptocurrencies using the Proof of Stake algorithm perform reward computation depending on their internal dynamics. Some cryptocurrencies limit the upper coin limits to be kept in the wallet for each user in order to avoid the possibility of inflation in prices. Those who want to perform staking on many cryptocurrencies can carry out staking by keeping the cryptocurrency at least up to the determined lower limit in their wallet. However, based on the basic logic of the staking algorithm, the more coins you have in your wallet, the greater the reward you will receive at the end of the process.

Cryptocurrency Staking Methods

If we can fully articulate the concept of Staking, let’s tell you how to stake cryptocurrencies. If you want to do staking and generate income from your investments in this way, you must first investigate the cryptocurrencies that support the Proof of Stake algorithm. You then need to determine your stake method later. The most preferred of these methods can be explained as follows.

What Is Staking Pool?

You do not have to use your own wallet to perform a stake transaction within this method. That is, you can host your cryptocurrencies in the wallet of big-budget verifiers who perform this transaction in order to staking out and win prizes over the cryptocurrency you specify. This method is called the Delegated Proof of Stake method. You can collect and lock your stakeable coins in a different and larger pool. This application is called staking pool. In the next process, you can receive your share of the prize received by the pool owner. In this process, the people who establish, develop and manage the pool also receive a certain amount of the reward.

What Is Cold Staking?

You must know the kind of cold wallet called Cold Wallet. Cryptocurrencies of this type of wallet are kept on a physical device (such as a flash memory) that is not connected to the internet. This way users can protect their cryptocurrencies against a possible hacking attack.

The model called Cold staking is also carried out with the method of keeping coins in cold wallets. The users who keep their coins in the cold wallet both protect their money against attacks and gain a reward for not re-circulating the stake.

Don’t Stake In Wallets

Numerous storage companies also have staking services in their crypto wallets. People who want to stake cryptocurrencies as holders of wallets outside the stock market can take advantage of this option. Off-the-market wallets are considered safer because they are far less attacked. What makes this option less advantageous is the fees set by the service provider platforms for staking service. To receive a service in this way, you may need to pay an average of 25-30% of your income to the service provider.

How Is Stock Trading Performed?

With the publication of the Proof of Stake algorithm in 2012, some cryptocurrency exchanges decided to perform this service on behalf of their users. Staking through the cryptocurrency exchange brings some advantages for the users. Prior to the Stake transaction, coin deposits, coin withdrawals and coin trading can be quickly traded on the stock exchanges. With a little research to do on the Internet, you can find which stock markets provide support to their users for staking transactions. Stock exchanges usually charge between 5% and 15% for services provided at this point.