Cryptocurrency exchange, real currencies (TL, Euro, dollar etc.) can be defined as an intermediary platform where coin buying and selling can be carried out in return or in exchange for cryptocurrencies.

As you know, some cryptocurrencies can be obtained by mining. Some, however, can only be obtained through the cryptocurrency exchange, as they are only developed based on a specific project and their release to the market is controlled by cryptocurrency manufacturers.

For example, we can count Bitcoin (BTC), Ethereum (ETH), BitcoinCash (BCH), Bitcoin SV (BSV), Litecoin (LTC) and many more cryptocurrencies. But mining processes are becoming more difficult as trading volumes increase and closer to the final coin amount determined in the context of finite supply. This makes the process difficult for people who want to own any of the cryptocurrencies.

However, through the cryptocurrency exchange, it is possible to have both cryptocurrencies that can be mining and those that cannot be mining.

How Does The Cryptocurrency Exchange Work?

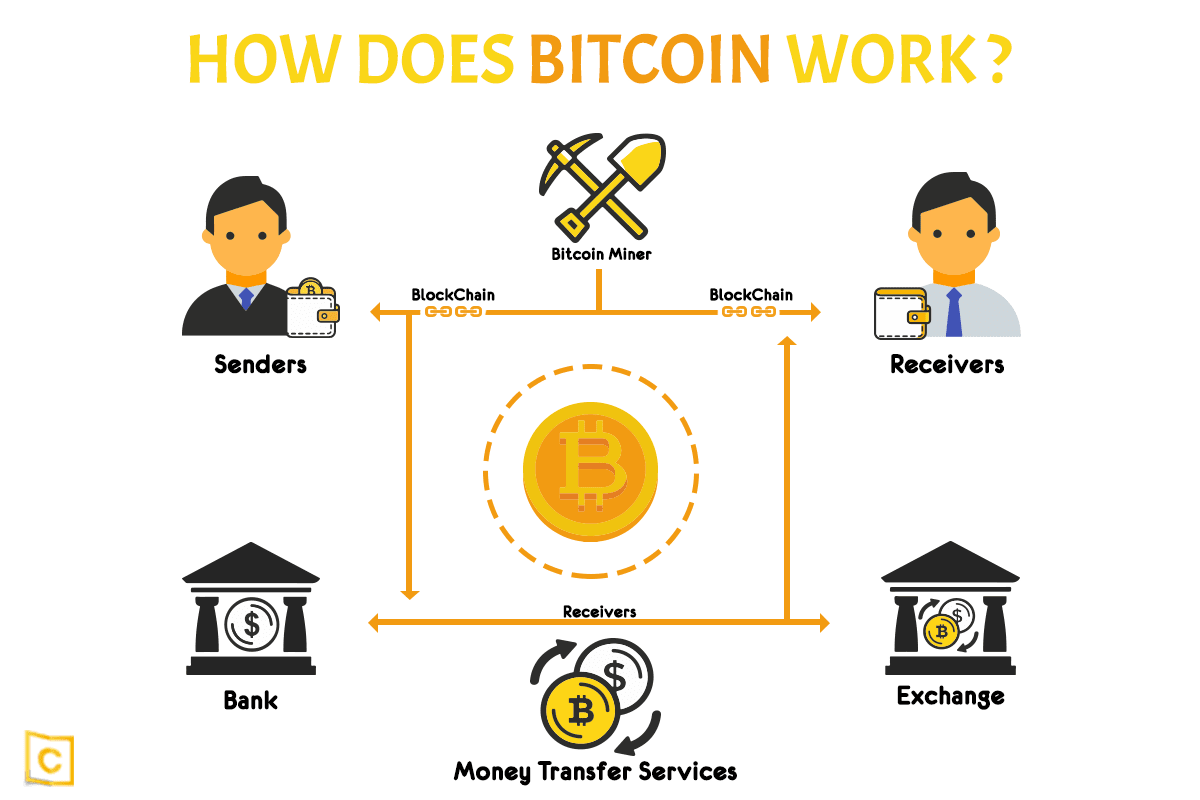

In order to make transactions through the cryptocurrency exchange, we need to understand its logic first. The cryptocurrency exchange is similar to traditional stock exchanges in terms of working logic and allows you to instantly trade coins.

There are stock exchanges that allow the exchange of cryptocurrencies in exchange for real money, as well as stock exchanges where you can trade coins in exchange for coins.

In order to be able to trade on cryptocurrency exchanges, you must first have one of the wallets created specifically for the cryptocurrency you want to trade. Then, depending on the transaction you want to make (buy or sell) you can also evaluate the offer made by a user who wants to trade in the stock market, you can make a purchase from a user who wants to sell in the cryptocurrency you want to buy, or you can make a sale to a user who wants to buy in the cryptocurrency

Many exchanges are traded with the operating principle of bidding procedure. This means that the prices of coins in the stock market are determined by the users trading on the stock market.

At this point, for users who create and trade accounts in more than one exchange, there is an opportunity to arbitrage by following the prices set by cryptocurrency exchange users. In other words, it is possible to gain by buying coins at a lower price in one exchange and selling them at a higher price by transferring them to your account at the other exchange.

Since cryptocurrencies are physically unrepresentative, cryptocurrency trading can only be done through the website. Besides this, there are also exchanges offering mobile application services like those offered by Papeleks. Exceptionally, some exchanges allow trading via cryptocurrency ATM. Papeleks offers its users the opportunity to trade with ATMs located in various parts of Turkey and Cyprus.

What Are The Differences Between Cryptocurrency Exchanges?

Cryptocurrency exchanges differ according to elements such as the type of transactions to be made in the stock market, the characteristics of the people who will trade in the stock market, the cryptocurrencies that can be traded in the stock market, or the geographic regions where services are offered.

Some cryptocurrency exchanges allow trading on only one coin, while others offer trading on more than one coin. It is possible to trade with many different cryptocurrencies via Papeleks.

Just as there are exchanges that allow cryptocurrency trading to take place only in exchange for real currencies, there are also exchanges that allow coin trading to take place in exchange for coins. We continue by stating that you can both exchange cryptocurrencies for real money and trade coins in exchange for BTC through Papeleks.

While some exchanges only accept individual customers, transactions can be made by corporate customers if necessary documents are submitted at Papeleks exchange.

In addition, some stock markets allow trading on a local scale, while others allow trading in every region on a global scale.

How To Trade On The Cryptocurrency Exchange?

In order to be traded on cryptocurrency exchanges, the conditions determined by the stock market must be met first. These terms may include creating an account, presenting a birth certificate or tax plate, or sharing certain information.

If you want to buy cryptocurrencies, then you can load a real money balance into your account or sell your existing cryptocurrencies, depending on the transaction you want to do.